Earlier in March, Cardiff University’s Wales Governance Centre published Wales’ Fiscal Future – a major paper on the fiscal (public spending, tax etc.) implications of both Welsh independence and the Union (pdf).

There are clearly more important things going on in the world right now and it’s not exactly light reading, but I’m assuming there was an expectation I’d go through it at some point.

The Nature of the Welsh Deficit

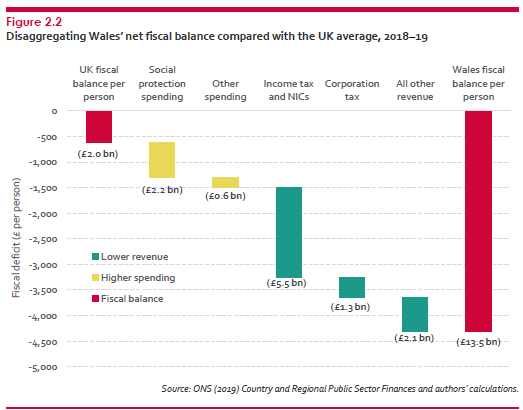

The difference between public spending and tax revenues in Wales, as of 2018-19, has been estimated at £13.5billion. With a gross value added (economic output) of around £75billion, the Welsh deficit is 18% of GDP compared to 2% for the UK as a whole.

The good news for nationalists is the deficit is coming down – dropping from 29% of GDP in 2009-10. The bad news, for everyone, is it’s not necessarily because the economy has grown, but because of public spending cuts/austerity.

The deficit is largely down to higher spending on welfare and state pensions than the UK average (£2.2billion) and lower tax revenues (£8.9billion). If spending-per-head in Wales matched the UK as a whole, the Welsh deficit would be just £2billion (2.7% of GDP) but that would mean a resulting loss of £11.5billion in identifiable and non-identifiable public spending (I’ll come back to this shortly).

Wales isn’t the only part of the UK carrying a deficit. Only three of the UK’s nations and regions pay in more than they take out. These massive regional differences often happen in overly-centralised states because the higher paid jobs and the economic centre of gravity are physically closer to the centre of power (London).

When it comes to household incomes, Wales comes off relatively well due to the tax and benefits systems. When compared to the Republic of Ireland, Welsh household incomes are just 8% lower despite Irish GDP-per-person being 230% higher than Wales.

The perceived wisdom is that Wales has always run a fiscal deficit – partly down to the flow of capital, partly down to the makeup of the economy at certain points in history (manufacturing and heavy industry have played a bigger part of the Welsh economy than many other parts of the UK – see also The Welsh Economy II: An Economic History In Brief) as well as changes in investment patterns.

Despite this, Wales was said to have run a surplus equivalent to 1% of total economic output between 1948-1956 because of increased private investment in Welsh industries after the Second World War.

Capital spending-per-head in Wales has long been lower than the rest of the UK, whilst revenue spending (money used for services, welfare etc.) has been higher.

So the types of investment that would otherwise support economic growth in Wales have been sacrificed for fiscal transfers (a large proportion of which is controlled by the UK Government, a proportion of which isn’t even spent in Wales but merely in our name), meaning a deficit is almost always maintained. The authors conclude that: “a change in the current fiscal position will require a fundamental change in either the nature of the UK economy or indeed in Wales’ constitutional settlement.”

Can Wales’ fiscal position improve within the UK?

The report says closing the fiscal gap within the UK would “require a substantial turn-around in fiscal, economic and demographic trends.”

The fiscal powers which have been devolved to Wales are unlikely to make a difference – for example, increasing income tax would raise additional revenues but also increase public spending overall, leaving the fiscal deficit unchanged.

Based on various predictions, the Welsh deficit could – by 2029-30 – lie somewhere between 9.4%-17.6% of GDP (in monetary terms, £7billion-£13.2billion at current levels) depending on how fast the economy grows.

Closing the economic gap with the rest of the UK would “require a substantial change in the UK’s current London-centric political and economic model” – including increased capital spending on infrastructure in Wales by the UK Government, more fiscal controls for the Welsh Government (including increased borrowing powers) and greater investment by the Welsh Government in areas such as education and research.

Demographically, Wales is slightly “top-heavy” (more over-65s compared to the rest of the UK), has a bulge at ages 18-25 due to being a net importer of students, but has fewer working-age people than the UK as a whole (partly down to lower levels of immigration) – which naturally impacts average earnings and tax revenues.

Higher graduate retention rates and higher levels of working-age international migration could help expand the tax base. If Wales matched the UK average in terms of demographics alone, it could reduce public expenditure by £1billion and increase tax revenues by £500million – effectively cutting the “deficit” by £1.5billion.

Boiling it down to the question: “Can the Welsh public spending deficit be closed within the UK?” it’s a “No” as it would require radical changes to how both the UK and Wales works as well as devolved powers which are unlikely to be forthcoming or palatable to the English electorate. The best-case scenario would still leave Wales with a deficit of around 8% of GDP.

The Welsh Deficit & Independence

Independence would be a double-edged sword. On the one hand, it would offer complete flexibility in terms of policy to close the deficit, but on the other hand the deficit would start at the stated £13.5billion.

As things stand, the total amount of identifiable public expenditure (money that can be specifically accounted to Wales) is around £33billion a year (compared to £29.5billion of Welsh tax revenues – p65). On top of this, there’s around £10billion of non-identifiable expenditure – UK spending which is hard to account to a single nation or region including debt interest, defence spending, foreign policy spending, UK spending abroad and accounting adjustments. So the total amount spent in Wales each year rises to just under £43billion.

The distinction between identifiable and non-identifiable expenditure is important because it could help decide where the Welsh deficit would be on day one of independence – depending on the policy choices we would be free to make, as well as negotiations regarding our share of the UK’s national debt and assets.

National debt – The report says there’s no legal mechanism for how a state’s debts are apportioned after independence, so it would be dependent on negotiations. At present, £2.7billion is spent on Wales’ behalf servicing interest on the UK’s national debt, which stands at just under £1.8trillion. It’s unlikely Wales would walk away from its debt obligations as it would risk causing ill-will and scupper negotiations. Based on various scenarios ranging from an equal share of debt-to-GDP as the UK to a population-based share, the report estimates Wales could inherit a debt of between £60-83billion, but this would also mean we would have a stronger claim to some of the UK’s assets.

The authors say creditors would likely want to maximise the chances of Wales paying the interest, which would lean towards a lower proportion of debt. While the report didn’t mention any figures, at an approximate 3% rate (roughly the same as current UK debt interest payments based on figures in the report) that would put annual Welsh debt interest payments at between £1.8billion-£2.5billion, so potentially saving £200-900million a year from the deficit, or £2.7billion if we left the UK debt-free (though that’s unlikely) – though this would gradually build up as Wales borrowed in our own right.

Defence (see also: Defending Wales): At present, £1.9billion is proportionally spent on defence in Wales on our behalf, which is around 2.5% of GDP. Matching the NATO target of spending 2% of GDP on defence would save £400million; matching spending with the current proportion of UK military personnel etc. based in Wales would save £1.2billion, while a defence budget proportionally similar to the Republic of Ireland – after taking Wales’ weaker economy into account (around £450million) – would decrease the deficit by up to £1.5-1.6billion.

State pension liabilities – The UK’s state pension system is a contributory-based system where you pay into a virtual central fund and where eligibility is determined based on national insurance contributions built up over your working life. If all current retirees continued to receive a UK/English state pension after independence (based on their state pension rights built up within the UK), with Wales only paying state pensions for those who retired after independence (taking control of pensions gradually over 30 years), it could potentially result in a £5billion reduction to the deficit at the start. However, the report assumes the Welsh Government would want complete control of state pensions from day one.

Expenditure outside of Wales accounted to Wales – Wales is assigned a share of UK spending outside Wales even if no money is actually spent in Wales (such as London-based civil services). Repatriation or the establishment of Welsh government departments after independence “could be economically beneficial” and result in increased tax revenues, potentially reducing the deficit by 0.5% of GDP (£375million) – though presumably there would be an upfront cost in duplicating departments.

Adding these together would reduce the Welsh deficit from £13.5billion to anything between £5.8billion-£12.5billion (7.7%-16.6% of GDP) depending on negotiation outcomes, policies and national debt.

The overall conclusion is:

“Taking into account the factors already discussed, the inherited fiscal deficit of an independent Wales could potentially be lower than the one presented in GERW. However, even under the most optimistic scenario, this deficit would remain large and an independent Wales would be inheriting what would likely be an unsustainable fiscal position.”

This is before considering the possible revenue-raising and fiscal policy options – though there’s not much good news there, particularly if you’re one of these nationalists who think there’s a bonanza in water and electricity.

Borrowing & economic performance – An independent Wales would be able to borrow like any other nation. The report says that if the fiscal gap was filled with borrowing – matched with economic growth in line with increased tax revenues (and/or spending cuts) – the debt-to-GDP ratio after independence would peak at anything between 44-73%; the better the economy performs after independence, the lower the debt. This includes the cost of paying interest on an unspecified share of UK debt and the cost of servicing new borrowing (p46-47) – though I’m not entirely sure how the authors worked that out.

Currency (see also: A Welsh Currency) – I’ve been through the arguments before, but choice of currency would result in differing outcomes depending on how much fiscal independence Wales wants (Welsh currency) versus minimising exchange costs and maintaining close economic ties with England (“pound zone”). A Welsh currency would offer maximum flexibility but would come with the cost of establishing new institutions, while a monetary union using the pound would likely be lop-sized but would provide a new Welsh state with greater fiscal credibility and minimise possible capital barriers with England.

Tax reforms – The UK raises considerably less tax than the rest of the EU. If Wales matched the EU tax-take average, we could potentially raise an additional £4.7billion. First of all, 46% of the Welsh working-age population don’t pay any income tax because of increases to the personal allowance and lower average earnings. There are also fewer higher-rate income tax-payers in Wales compared to the UK. While income taxes could potentially increase or stay the same (by the personal allowance being cut/more tax bands being introduced), there’s more incentive for Wales to cut VAT and corporation tax (because we generate far less money from the latter in particular) – though this would threaten a “race to the bottom”. Simplifying the tax code could also result in a reduction in a “tax gap” between the amount due to be paid to HMRC and the amount actually paid – a high estimate for Wales putting it at £1.25billion (though it’s likely to be much lower than this).

Water & electricity exports – As things stand, Wales is part of a single energy market (National Grid) and the report says it’s therefore very difficult to see how Wales could stand apart in this without breaking up the grid. While Wales produces 15.3 TWh more than we consume, the market price per MWh in 2018 was £58 and Welsh electricity exports at market value were worth £890million (tax or levies from this would be even lower). Similarly water, whereby costs would have to be kept below £300million to keep Welsh water abstractions more attractive to English-based water companies than pursuing desalination as a matter of national security: “Potential revenues from any levy or tax on water exports are therefore unlikely to place a big dent in the size of the fiscal deficit.” I’ve made this point before, but the value in water and electricity isn’t in the raw material, but in providing the service itself.

Dark economy – The ONS calculates spending on narcotics and sex work as part of its consumption statistics and estimates suggest Wales consumed £206million worth of illegal drugs and £230million on sex work (Vice Nation: Prostitution) during 2016. Tax revenues from this, if licenced, regulated and legalised, are likely to be small and any decision ought to be based on political and ethical considerations of the effect on the population and those working in these “industries”. You won’t close the deficit to any great extent by legalising weed.

The report cites evidence suggesting independence can both increase and decrease economic output – so it’s inconclusive. While The Flotilla Effect argues that smaller nations tend to outperform larger nations in a globalised economy for multiple reasons, the economies of former Soviet and Yugoslav states are lower than they otherwise would have been – so independence causes an economic shock, though perhaps how a nation achieves independence is a key factor in how it impacts its economy: war (former Yugoslavia) vs peaceful secession (Czech Republic and Slovakia).

Conclusions: Nothing we didn’t already know, but gauntlet thrown down to both nationalists and Unionists

The paper is, as its authors describe, a sober analysis of Wales’ current fiscal situation. From the outset, the authors state it’s difficult to determine how independence would affect the Welsh economy – positively or negatively. For the foreseeable future, the fiscal deficit remains a seemingly irreversible roadblock to independence even if the report suggests the deficit could be a fair bit lower on day one of independence without causing any real pain; recent events have shown us that Wales wouldn’t really miss UK defence spending.

While the report is very close to, but falls short of, an outright “No” to independence it’s not a resounding endorsement of the Union either and shouldn’t be interpreted as such. If anything, the report poses as many questions for Unionists as nationalists.

If the most independence-friendly policy proposals and circumstances, as outlined in the report (low share of post-UK national debt, no immediate state pension liabilities, lower defence spending, tax income matches EU average), were the outcome then the deficit could be cut to as low as £1.1billion – but absolutely everything would need to go our way for it to happen.

Realistically it would be higher than that, though very few states run a surplus and Wales should still be able to run a sustained deficit of maybe no more than £2billion a year (about 2.7% of GDP). That’s a “dream scenario”, but it would take some serious thinking and tinkering to even get into that position. For nationalists, the stuff about water and electricity needs to stop; it’s a sovereignty argument (Wales should control its own natural resources), not an economic one.

For Unionists, the authors state what many of us who support independence have said for a long time: Wales is in a politically-managed decline caused by continuous neglect within the UK.

Despite all of this money totted up on our behalf, we’re no better off. The welfare safety net – a supposed benefit of the UK’s “social solidarity” – is less compassionate and being slowly dismantled. Policy decisions taken at a UK level actively harm the Welsh economy, while we can’t work to our own strengths. We’re not getting the kind of investment needed from successive UK governments (possibly Welsh governments too) to turn around our economy and are unlikely to ever do so because the focus has long been on London and south-east England overheated, overcentralised economy acting as the UK’s banker, breadwinner and accountant at the same time.

You can either accept the risks and break that cycle – but will need a cast-iron economic, monetary and fiscal plan. Or, you’ll have to argue that a post-EU UK will maintain this for perpetuity and why that would be a good thing for Wales.

This article was originally published by stateofwales.com.